Loyalty Solution for Banking, Finance Service and Insurance (BFSI) industry

Among a lot of the same kinds of offers from Banks or Insurance companies, Customers still find it difficult to choose a relevant one that truly match their needs. And once they find it, they are quick to grab it. Therefore, a data-driven loyalty program can help you standout among competitor and keep your customer loyalty.

Challenges in the Banking, Finance Service and Insurance (BFSI)

Lack of Relevant Insight

Limit data accessing from your core banking data to create customer-centric benefits due to concerns over data security and data privacy policy

Struggle to manage Omnichannel loyalty programs

The rise of digital banking create gaps to manage customers engagement across online and offline touchpoint

Difficult to connect at emotional levels

Banks & Insurance companies are being lost among competitors because of lack of balancing benefit offers between emotional and rational

Let's find the best loyalty program structure for you!

CONTACT US

Our solution tailored for Banking, Finance Service and Insurance (BFSI)

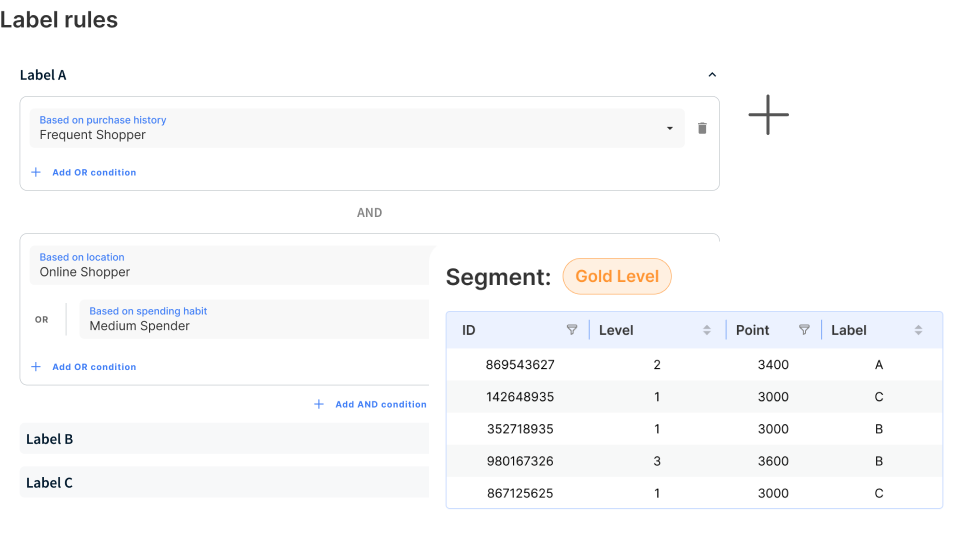

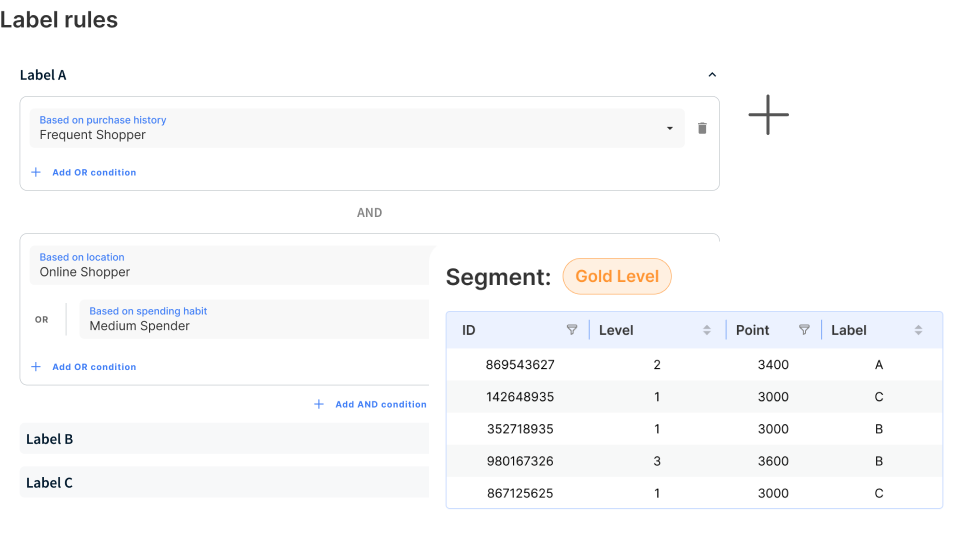

Relevant programs by dynamic “labels”

Keep up with relevant program offers to your customers based on their insight while ensuring the security of your data

Dynamic Tags” for smart & precise segmentation

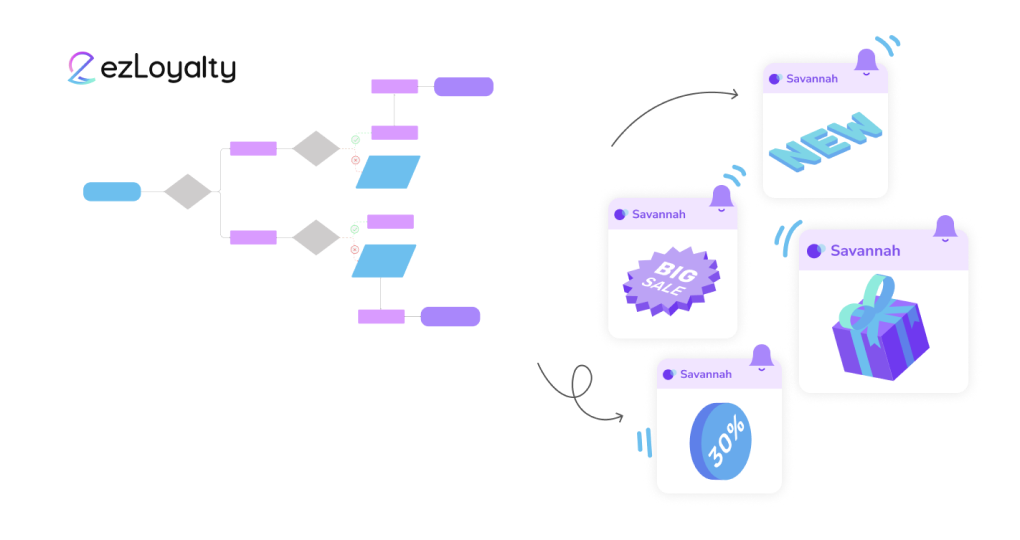

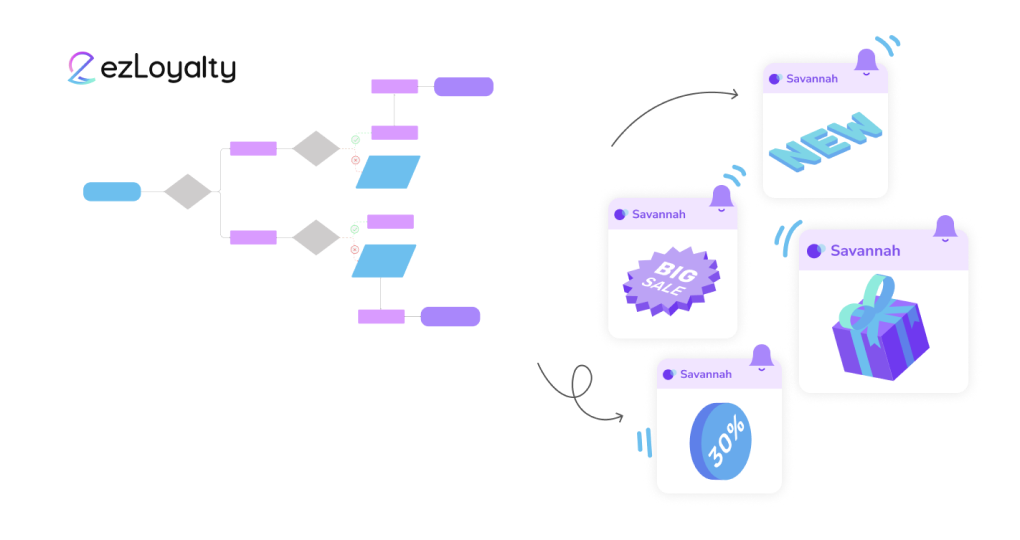

Omnichannel marketing automation

Manage your Omnichannel loyalty programs with ease to provide a seamless connection with personalized conversations and engagements at the right time on the right channels

Omnichannel Marketing automation based on real-time activities

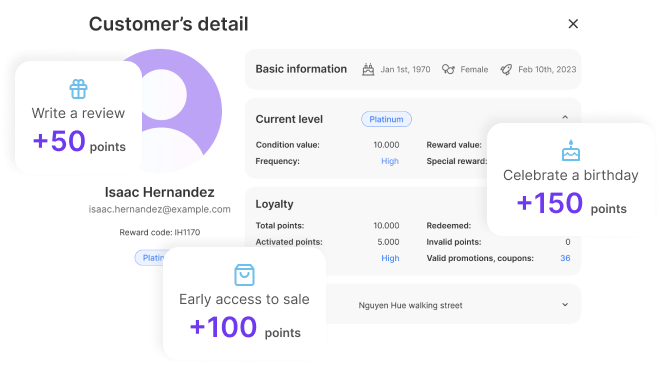

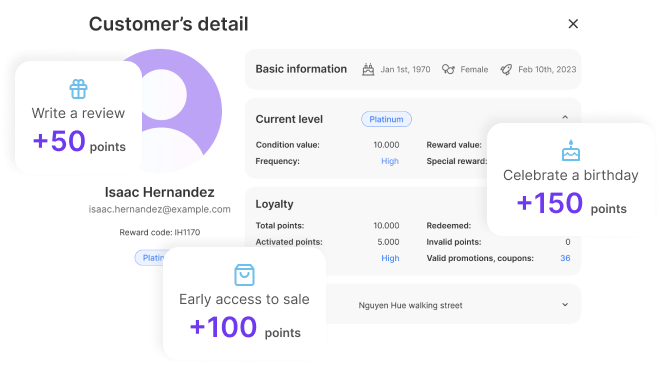

Rational and emotional programs

Build bond relationship with your valued customers by offers outstanding loyalty programs that balances between transactional & non-transactional activities

Transactional loyalty schemes

– Earn & Burn rules

– Multi-Tier

– Rewards

Non-transactional loyalty schemes

– Behavior based

– Events based

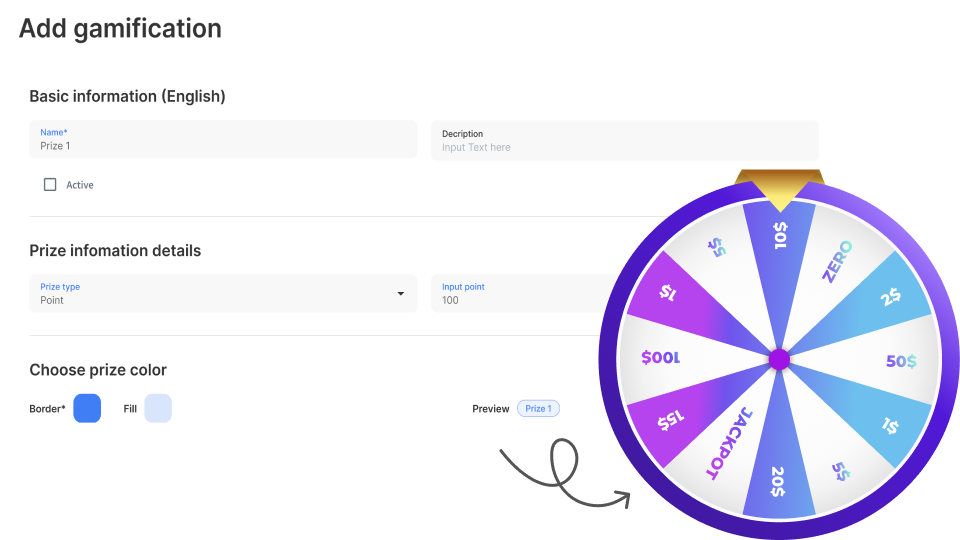

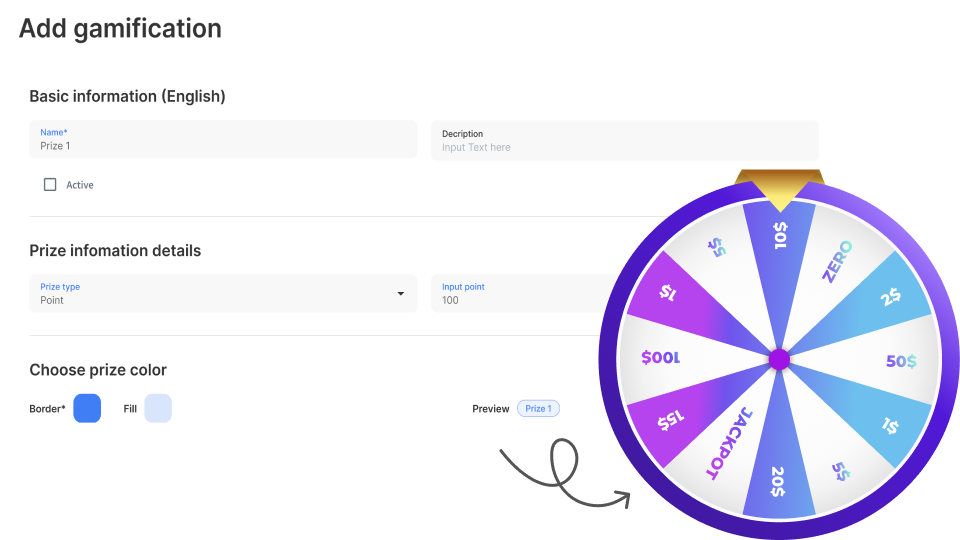

Gamification programs

Increase daily active users and encourage recurring behavior

Gamification program

Our solution tailored for Banking, Finance Service and Insurance (BFSI)

Relevant programs by dynamic “labels”

Keep up with relevant program offers to your customers based on their insight while ensuring the security of your data

Dynamic Tags” for smart & precise segmentation

Omnichannel marketing automation

Manage your Omnichannel loyalty programs with ease to provide a seamless connection with personalized conversations and engagements at the right time on the right channels

Omnichannel Marketing automation based on real-time activities

Rational and emotional programs

Build bond relationship with your valued customers by offers outstanding loyalty programs that balances between transactional & non-transactional activities

Transactional loyalty schemes

– Earn & Burn rules

– Multi-Tier

– Rewards

Non-transactional loyalty schemes

– Behavior based

– Events based

Gamification programs

Increase daily active users and encourage recurring behavior

Gamification program

3 steps to bring your loyalty solutions "go live"

A lean process from design to implement and manage that is economical for your business

1. Design a loyalty program

With expert consulting, mechanics, and UI/UX design that can reflect your brand’s values. Let ezloyalty create your customer-will-love loyalty program from start to finish!

2. Implement the platform

Integrate with your existing solutions – Build additional custom program functionalities that will fit your business (Enterprise model) or go live in just 8 weeks (SaaS model).

3. Manage your program

Have our loyalty professionals optimize your day-to-day marketing operations – we’ll show you how to push the technology to the max, so you can improve your program’s performance and maximize ROI.

Discover more of the possibilities for your industry-tailored loyalty program

BOOK A DEMO